September 16, 1999

Dear John:

Proposal for medium term investment of a sum of money ($5,000 - $20,000)

I understand that you may want to invest some money for use in the medium term - 3 to 6 years. You have asked me to recommend an investment plan.

Time vs volatility

The longer money is invested, the more volatility an investor can accept. When the money is to be withdrawn at a known date in the near future, it advisable that as the date approaches it should be held in non-volatile investments.

Volatility is a characteristic of growth investments. To achieve any significant growth (ie better than 10% per year on average) some degree of volatility must be accepted. Low volatility securities like mortgages and bonds will not achieve such growth.

We are approaching a time when volatility of the markets as a whole is expected to be quite high, as a result of the implications of the year 2,000 effect. Probably, markets will dip towards year end. In January, with the danger of microprocessor failures behind us, or at least quantified, the economy is expected to surge as companies re-stock with inventory that they delayed buying until after Jan 1, 2000.

How to capitalize on the expected dip at year end.

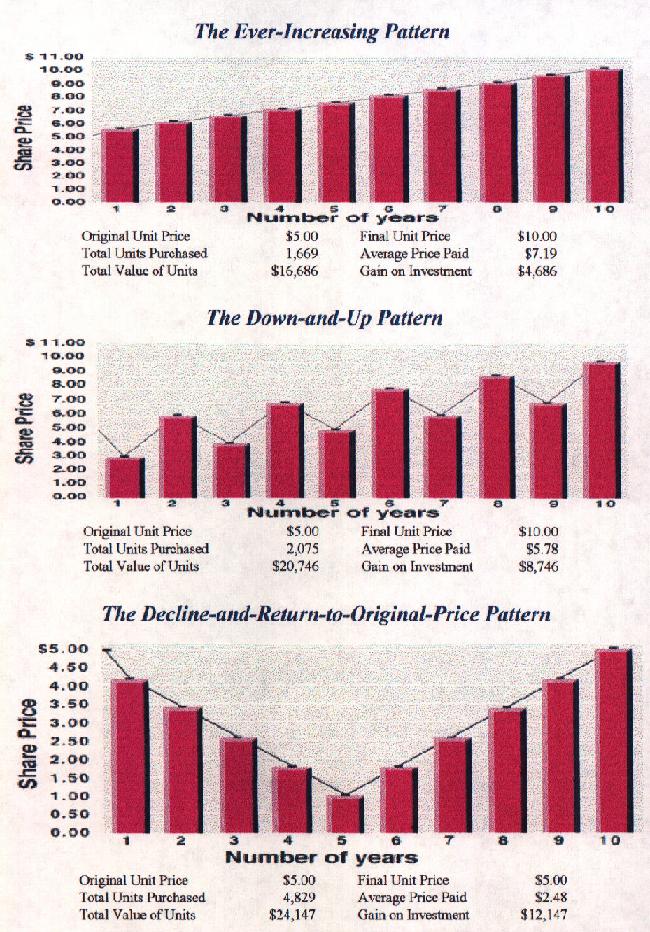

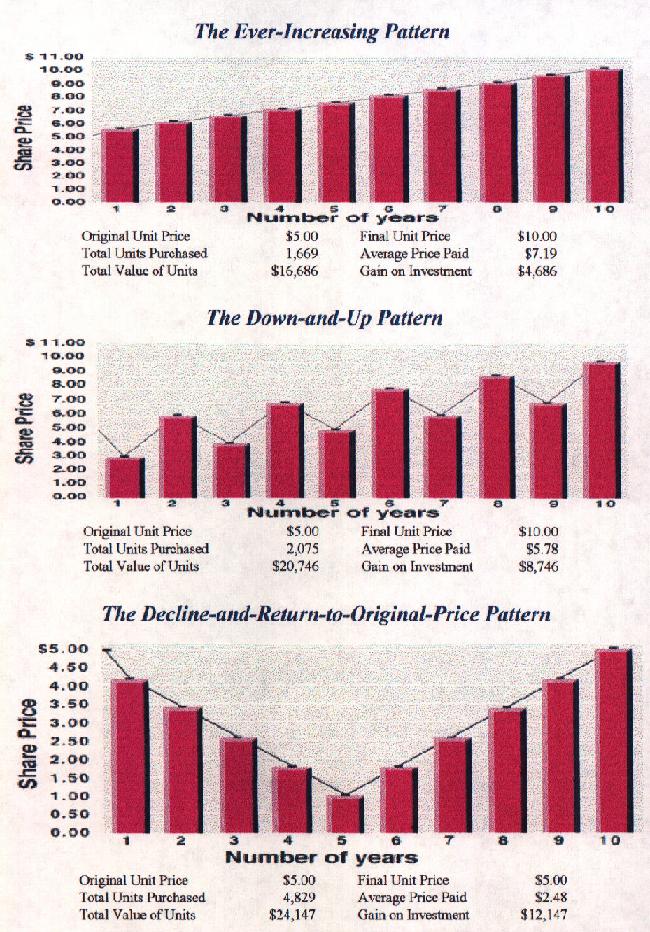

The classic dollar cost averaging scenario is when markets dip severely, but recover, and the investor contributes the same regular sum on a monthly or bi-weekly basis throughout. This is shown in the third diagram below. Notice that the gain on investment is far higher than in either of the first two diagrams.

Here are three examples which show the potential outcome of investing $100 per month regularly, over a 10-year period under different stock market conditions. Income and capital gains dividends are not reinvested for more units.

I would therefore suggest that your lump sum be invested in a money market fund now that the markets are relatively high, and we transfer about 15% of it monthly into an equity fund, which will likely exhibit the above pattern. If the markets fall before December 31 as some have predicted, the majority of your money will be insulated against the fall since the capital is guaranteed in the money market fund. On January 2, I recommend transferring the remaining balance into the equity fund.

What equity fund(s) should you use use?

It should be a North American equity fund, since the Y2K effect is likely to be more pronounced in North America. Final contenders on my short list are:

North American Growth. A combination of US and Canadian stocks, currently lagging in performance because of the Canadian natural resources contingent, so relatively cheap to buy.

Growth Portfolio A fund of international equity funds with a North American predominance. Widely diversified.

US Opportunities A medium cap US fund that exhibits slightly more volatility than its large cap neighbours.

Of these I marginally favour the Growth Portfolio because of its long term steady excellent performance, even if my prediction for the market fall and rise turns out to be wrong, this fund would still be an excellent choice.

I hope you agree with this plan. If it succeeds it could net you well over the normal growth rate of the funds listed above.

Yours truly

Tony Copple, CFP.

Return to Finance Page